TT Meridian, a leading international logistics and trading company specialising in the UK and Vietnam markets, on May 19 announced a new all-cargo air route between the UK and Vietnam via Turkmenistan. Turkmenistan Airlines cargo plane at London Stansted Airport is about to fly back to Vietnam, transiting Turkmenistan The new route, announced by the company on May...

SITUATION OF IMPORT AND EXPORT OF VIETNAM'S GOODS IN THE SECOND HALF OF APRIL 2023 (FROM 16 TO 30 APRIL, 2023)

The latest preliminary statistics of the General Department of Customs show that the total import and export value of Vietnam's goods in the period of second half of April 2023 (from 16th to 30th April, 2023) reached 26, $78 billion, an increase of 2.7% (equivalent to an increase of $702 million) compared to the results in the first half of April 2023. The results achieved in the second half of April 2023 brought the total import-export value of the whole country in the four months of 2023 to reach US$ 206.76 billion, down 15.3% (equivalent to US$ 37.47...

250 PROCEDURES CONNECTED WITH NATIONAL SINGLE WINDOW

In addition to connecting the National Single Window, the General Department of Customs is coordinating with relevant ministries and agencies in connecting the Single Window with partners inside and outside the ASEAN region. As the Standing Agency of the National Steering Committee on ASEAN Single Window, National Single Window and Trade Facilitation (Steering Committee 1899), the General Department of Customs has been urging and closely working with ministries and agencies to implement the National Single Window, the ASEAN Single Window, and ASEAN Trade Facilitation. Accordingly, the General Department of Customs has mobilized resources to build a master plan for developing an information...

VIETNAM RANK DOWN 4 STEPS IN 2023 LOGISTICS PERFORMANCE INDEX

After 5 years of waiting, the World Bank (WB) has just announced the Logistics Performance Index (LPI) Ranking 2023 on the evening of 21st April, 2023. Vietnam's LPI in 2023 ranked 43rd, down 4 steps compared to the "spectacular" 39th of 2018. Accordingly, the world leader is still Singapore, the second is Finland, the third is Denmark, Germany, the Netherlands and Switzerland. “Logistics is the lifeblood of international trade, and conversely, trade is a powerful driver of economic growth and poverty alleviation,” said Mona Haddad, Global Director of Trade, Investment and Capacity of competition, World Bank shares. Notably, in the LPI rankings in...

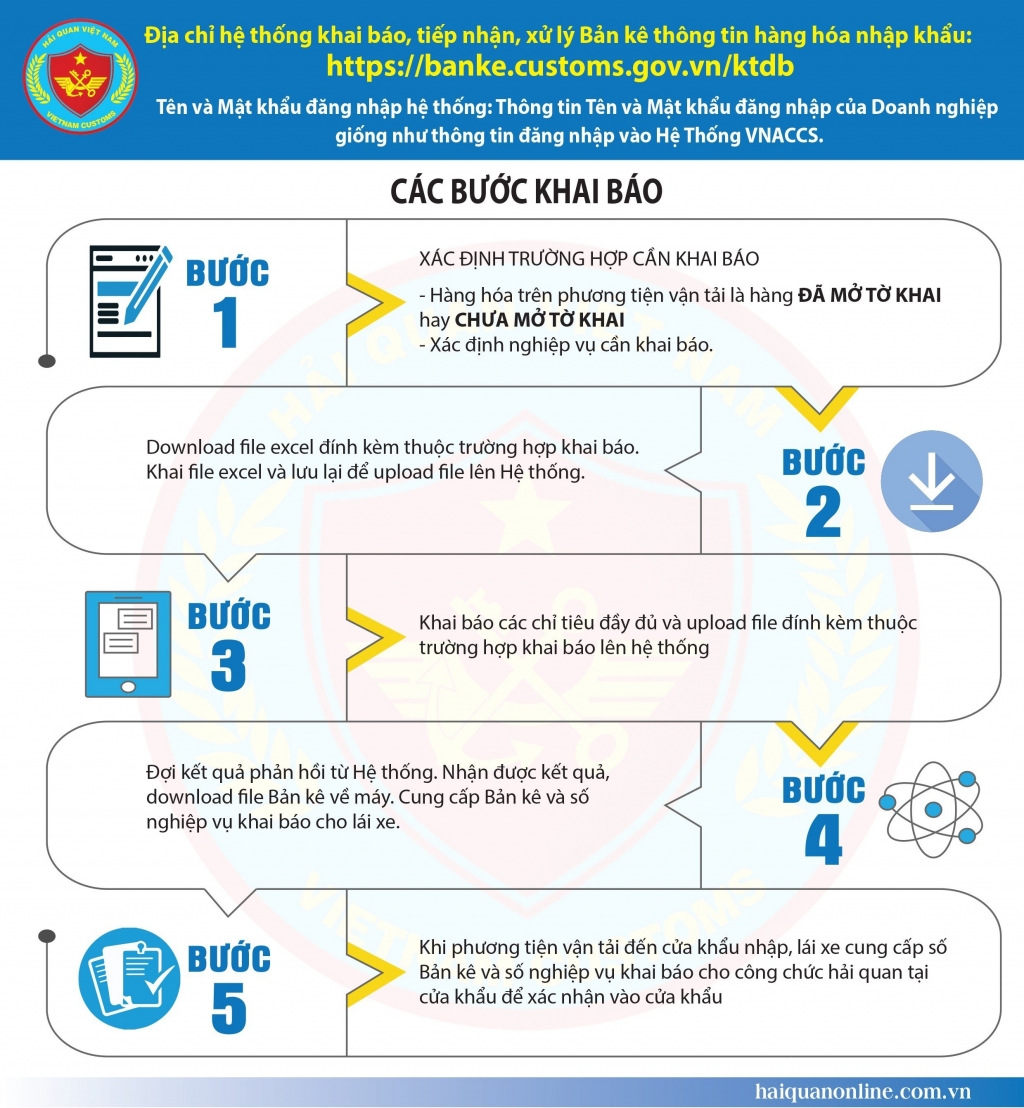

DECLARE GOODS INFORMATION PASSING THROUGH BORDER GATE ON THE ELECTRONIC SYSTEM

From 20th April, 2023, instead of making declarations with paper documents, businesses carrying out procedure declaration through land and waterway border gates will declare electronic declarations of imported goods. The General Department of Customs has Document No. 1790/TCHQ-GSQL guiding the implementation of declaration, receipt, inspection and certification of electronic manifests of imported goods. Accordingly, from April 20, 2023, the truck owner, the truck driver, the person authorized by the truck owner (the goods owner or the authorized customs agent) declare a list of imported goods information (hereinafter referred to as the manifest) before bringing goods into the Vietnamese territory according to...

THE GOVERNMENT HAS AGREED TO THE MINISTRY OF FINANCE TO SUBMIT A PLAN TO REDUCE VAT BY 2%

Deputy Prime Minister Le Minh Khai agreed in principle that the Ministry of Finance would report to the Government for submission to the National Assembly and the National Assembly Standing Committee for consideration and permission to formulate and issue a National Assembly's Resolution on value-added tax reduction. In 2023 the Ministry of Finance proposes to reduce the VAT rate by 2% for all goods and services subject to the 10% tax rate (to 8%); reduce 20% of the percentage rate to calculate VAT for business establishments (including business households and business individuals) when issuing invoices for all goods and services...