Tổng cục Hải quan ban hành Công văn số 3853/TCHQ-GSQL ngày 14/8/2024 gửi Cục Hải quan các tỉnh, thành phố thông báo việc cập nhật hệ thống của Hội đồng Xúc tiến thương mại quốc tế Trung Quốc (CCPIT). Theo thông báo của Tổng cục Hải quan, trên cơ sở thông báo của cơ quan có thẩm quyền cấp Giấy chứng nhận xuất xứ hàng hóa (C/O) của Trung Quốc về hệ thống cấp C/O của Hội đồng xúc tiến thương mại Trung Quốc (CCPIT), số tham chiếu C/O do CCPIT ban hành vẫn theo phiên bản cũ gồm 16 chữ...

CHÁY PHÒNG CNTT TỔNG CỤC HẢI QUAN

Khoảng 18 giờ ngày 6/8, một đám cháy đã bùng phát tại Cục CNTT của Tổng cục Hải quan, gây hư hỏng hệ thống máy tính hải quan và kiểm dịch/kiểm tra chất lượng (Hệ thống một cửa quốc gia). Do lo ngại hệ thống có thể không hoạt động bình thường, cán bộ hải quan có kế hoạch sử dụng hệ thống quân đội để vận hành hệ thống chủ yếu cho các nhiệm vụ thiết yếu và sử dụng quy trình báo cáo bằng giấy cho đến khi hệ thống được khôi phục. *Tóm tắt văn bản chính thức...

DISCOVERIES OF IMPORTING BANNED GOODS BY HO CHI MINH CITY CUSTOMS

According to the Ho Chi Minh City Customs Department, at Tan Son Nhat International Airport, the Customs agency manages and coordinated with competent authorities inside and outside the sector to arrest the illegal transportation of goods such as used electronic devices (on the List of goods banned from import), mainly imported from Singapore and Korea to Vietnam. In May 2024, Tan Son Nhat International Airport Customs Sub-department discovered a violation by the ground staff of a ground service company passing through the internal gate control area that transported 1 paper bag containing 25 used iPhones, Samsung cell phones, and 100 bills...

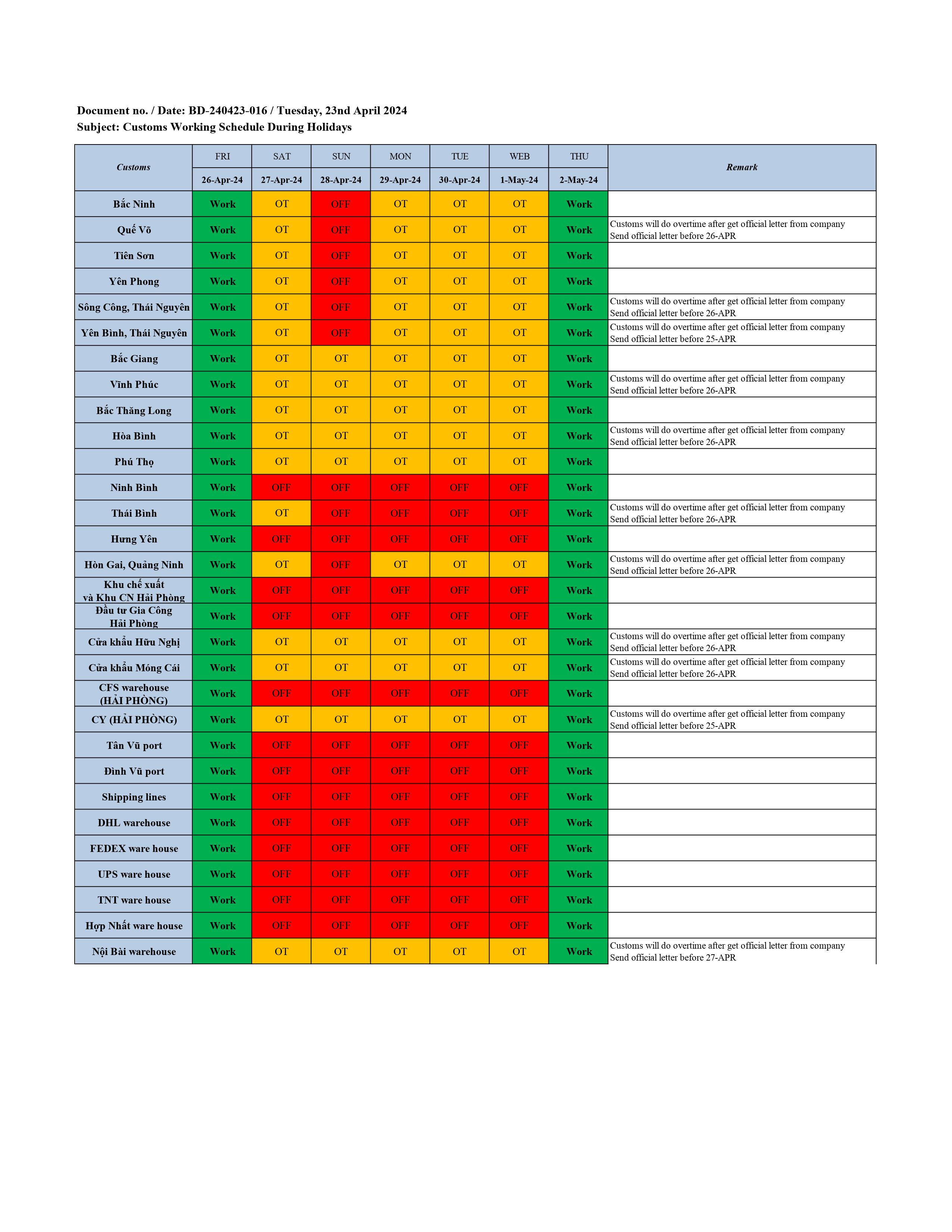

CUSTOMS WORKING SCHEDULE DURING HOLIDAYS

Today we are so pleased to provide you with the news about customs working schedule during Reunification Day and International Workers' Day from April 27 (Sat) to May 1 (Wed). Bac Giang, Vinh Phuc, Hoa Binh, Bac Thang Long, and Phu Tho customs offices operate Over Time throughout the holiday, and customs offices such as Bac Ninh, Que Vo, Yen Phong, and Thai Nguyen operate overtime throughout the holiday except for Sunday (28th). However, please note that some customs offices and warehouses, such as CFS warehouses in Hai Phong port and Ninh Binh, Hung Yen customs will not be operating throughout...

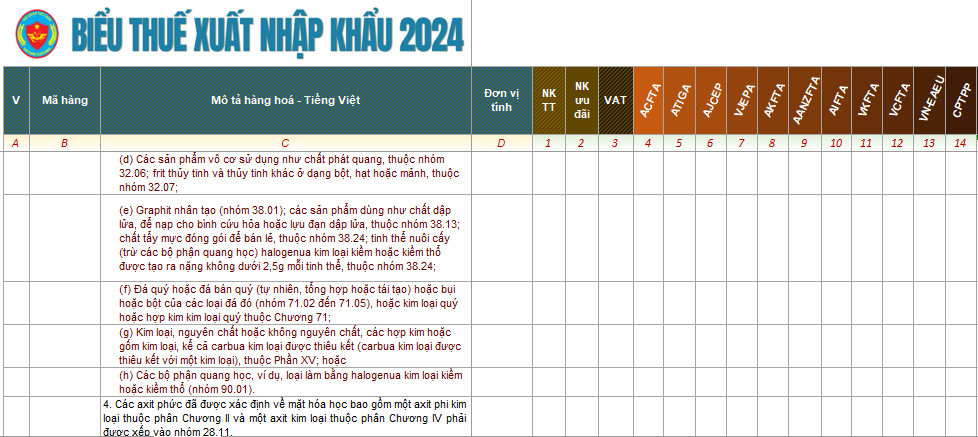

IMPORTANCE OF THE CORRECT HS CODE AND UTILIZING PRE-DETERMINATION OF CODE

HS CODE stands for Harmonized System Code, a unique number assigned to classify all traded goods internationally. Determining the HS CODE of traded goods based on legal provisions and product characteristics is referred to as 'Classification (Nomenclature).’ The reason why accurate classification is crucial lies in the fact that various aspects such as Duty and Tax rates, import/export requirements, exemptions, refunds, and FTA rules of origin are determined by the HS CODE of the goods. Frequently disputes between companies, customs authorities, exporters and importers, and exporting and importing countries arise due to inconsistent classification. Recently, there have been many cases where Vietnamese...

HO CHI MINH CUSTOMS PROPOSES REDUCING VAT FOR GOODS AND SERVICES

Ho Chi Minh City Customs Department proposed that the Ministry of Finance advise the Government to apply a reduction in the Value Added Tax (VAT) rate by 2% for all groups of goods and services currently subject to the 10% VAT rate, to be uniform at the stages of import, production and consumption. According to Ho Chi Minh Customs Department, during the implementation of the Decree on VAT reduction, a number of difficulties and problems arose related to identifying and distinguishing goods and services that are not eligible for VAT reduction from goods that are subject to VAT reduction. In order to...