Vietnam’s foreign contractor tax (FCT) is a tax that is applied to transactions conducted in Vietnam between a foreign company or sub-contractor and a Vietnamese company. It is made up of two kinds of taxes. Accordingly, the foreign contractor will be subject to FCT including: (1) value-added tax (VAT) and (2) corporate income tax (CIT) if it is an enterprise / or personal income tax (PIT) if it is an individual in accordance with the provisions of the foreign contractor tax law. Vietnam’s foreign contractor tax is applicable when carrying out business in Vietnam under a contract signed with a Vietnamese party...

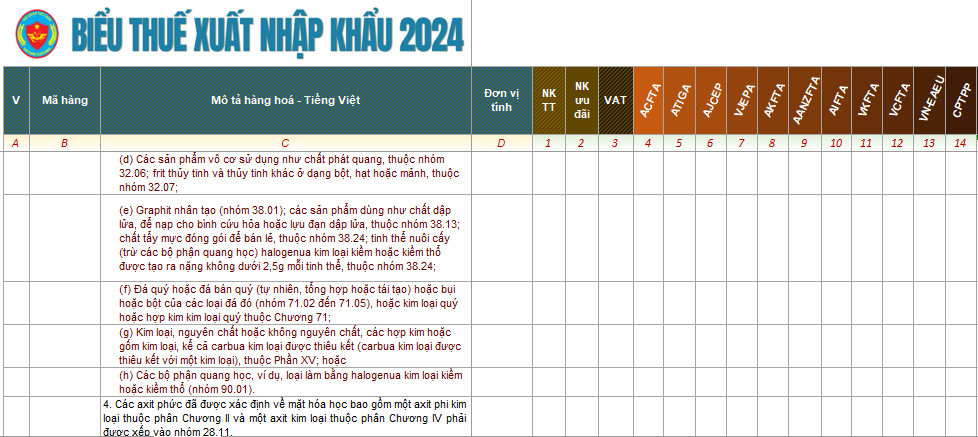

IMPORTANCE OF THE CORRECT HS CODE AND UTILIZING PRE-DETERMINATION OF CODE

HS CODE stands for Harmonized System Code, a unique number assigned to classify all traded goods internationally. Determining the HS CODE of traded goods based on legal provisions and product characteristics is referred to as 'Classification (Nomenclature).’ The reason why accurate classification is crucial lies in the fact that various aspects such as Duty and Tax rates, import/export requirements, exemptions, refunds, and FTA rules of origin are determined by the HS CODE of the goods. Frequently disputes between companies, customs authorities, exporters and importers, and exporting and importing countries arise due to inconsistent classification. Recently, there have been many cases where Vietnamese...

HO CHI MINH CUSTOMS PROPOSES REDUCING VAT FOR GOODS AND SERVICES

Ho Chi Minh City Customs Department proposed that the Ministry of Finance advise the Government to apply a reduction in the Value Added Tax (VAT) rate by 2% for all groups of goods and services currently subject to the 10% VAT rate, to be uniform at the stages of import, production and consumption. According to Ho Chi Minh Customs Department, during the implementation of the Decree on VAT reduction, a number of difficulties and problems arose related to identifying and distinguishing goods and services that are not eligible for VAT reduction from goods that are subject to VAT reduction. In order to...

CUSTOMS GUIDED DUTY OF FDI ENTERPRISES USING THE TAX EXEMPTION LIST

To facilitate FDI enterprises in using the Tax Exemption List, Customs sub-department of investment goods management - Ho Chi Minh City Customs Department provided detailed instructions for businesses as following: According to the provisions of Clause 15, Article 1 of Decree No. 18/2021/ND-CP, amending and supplementing Article 30 of Decree No. 134/2016/ND-CP regulating the responsibilities of the using of tax-free goods and notification of the using of tax-free goods on the Tax Exemption List, annually, within 90 days from the end of the financial year, enterprises are responsible for reporting the situation of the using of tax-free goods in the financial...

THE CUSTOMS SECTOR STRICTLY MANAGES TO ACHIEVE BUDGET TARGET AT THE END OF 2023

From now until the end of the year, the Customs sector will focus resources to facilitate trade, support businesses in import and export, strictly control tax collection and prevent loss of state budget, ... to complete target of state budget of the Customs sector in 2023 through the following specific methods: 1. Focus on promoting administrative procedure reform; focus on resolving difficulties for businesses promptly; create favorable conditions for businesses to develop stably and firmly, attract investment and promote economic growth in order to create a premise for increasing state budget. 2. Along with creating favorable conditions for businesses, customs continues to increase...

LAUNCHING OF ASEAN TARIFF FINDER

The Secretariat of the Association of Southeast Asian Nations Asia (ASEAN) in collaboration with the Indonesian Ministry of Trade and the Australian Government launched ASEAN TARIFF FINDER on 19th August 2023 of the 55th ASEAN Economic Ministers Meeting (AEM). ASEAN TARIFF FINDER is an online portal that provides information in English on customs tariffs and taxes, origin regulations and import regulations of more than 160 countries. ASEAN TARIFF FINDER also provides detailed information on Most Favored Nation (MFN) tariff, import quotas and preferential taxes for all types of goods originating from ASEAN member countries, as well as additional taxes on import. In addition,...