From now until the end of the year, the Customs sector will focus resources to facilitate trade, support businesses in import and export, strictly control tax collection and prevent loss of state budget, ... to complete target of state budget of the Customs sector in 2023 through the following specific methods: 1. Focus on promoting administrative procedure reform; focus on resolving difficulties for businesses promptly; create favorable conditions for businesses to develop stably and firmly, attract investment and promote economic growth in order to create a premise for increasing state budget. 2. Along with creating favorable conditions for businesses, customs continues to increase...

RESTORE OPERATIONS AT MUONG KHUONG BORDER GATE, LAO CAI

Lao Cai Provincial People's Committee has just decided to restore operations at Muong Khuong border gate in Muong Khuong district. It is expected that from 27th July, 2023, activities will be restored at the Muong Khuong border gate (Lao Cai, Vietnam) - Kieu Dau (China) to restore import-export activities through this border gate. In the coming time, Lao Cai Provincial People's Committee will assume the prime responsibility and coordinate with the forces involved in the management of Muong Khuong border gate to organize the restoration of import and export activities through this border gate. At the same time, the Management Board...

NEW EXPORT AND IMPORT TARIFF SCHEDULE UNDER DECREE NO.26/2023/ND - CP AND DECISION NO.15/2023/QD-TTg EFFECTIVE FROM 15TH JULY 2023

On 31st May, 2023: 1. The Government issued Decree No. 26/2023/ND-CP (Decree 26) promulgated the export tariff schedule, Most Favoured Nation (“MFN”) import tariff schedule, list of goods and absolute tariff, mixed tariff, out-of-quota tariff. 2. The Prime Minister signed off Decision No. 15/2023/QD-TTg (Decision 15) promulgating the normal import tariff applied to imported goods. The new export and import tariff schedule will be effective from 15th July 2023. In Decree No. 26, three main groups of contents have been amended and supplemented, such as: Converting the export tariff schedule, Most Favoured Nation import tariff schedule, list of goods and absolute tariff, mixed...

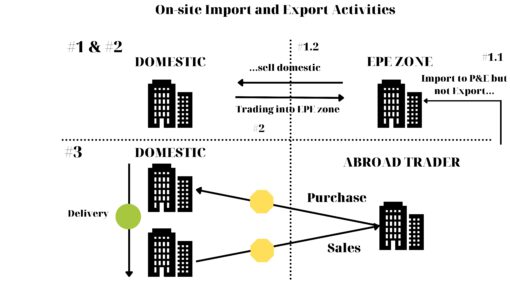

PLAN FOR CHANGING REGULATION OF ON – THE – SPOT EXPORT AND IMPORT

On 29th May, 2023 the General Department of Customs has just issued Official Letter 2588/TCHQ-GSQL 2023 on commenting on the draft amendment and supplement to Article 35 of Decree 08/2015/NĐ-CP for on-the-spot export and import. 1. Currently, Customs procedures of on-the-spot exported and imported goods is regulated as Article 35 Circular 08/2015/NĐ-CP dated 21st January, 2015: Article 35. Customs procedures that must be followed by on-the-spot exports and imports 1. On-the-spot exports and imports shall include: a) Those produced in Vietnam under contract manufacturing arrangements and sold to Vietnamese organizations or individuals by overseas ones; b) Those traded under the sale and purchase contract between...

VIETNAM - KOREA OFFICIALLY CONNECT THE EXCHANGING ELECTRONIC CERTIFICATE OF ORIGIN (EODES) FROM 1ST JULY 2023

Vietnam - Korea have just signed a Joint Statement on technical connection of EODES Electronic Origin Data Exchange System, supporting the transmission and reception of Certificate of Origin (C/O) data through the EODES system between the two countries effective from 1st July 2023. The transmission and reception of Certificate of Origin (C/O) data through the EODES system between Vietnam and Korea speeding up the process and procedures for issuing C/O in the exporting country as well as customs clearance of goods based on electronic C/O data to get the VKFTA and AKFTA tariff preferences in the importing country, reducing the pressure...

IMPORTED PROCESSED PRODUCTS FOR EXPORT PROCESSING NOT SUBJECT TO IMPORT TAX REFUND

According to regulations, the processed products that are imported and then processed in Vietnam for export are not subject to an import tax refund. The country’s top customs regulator cites Article 19 of the Law on Import and Export Duty as saying that cases of tax refund are below: Any taxpayer who has paid export duty or import duty but has no exports or imports, or the number of exports or imports is smaller than the quantity on which duty is paid; Any taxpayer who has paid export duty but the exports have to be re-imported will receive a refund of export duty...