Theo Trung tâm Dự báo Khí tượng Thủy văn quốc gia và các đài khí tượng quốc tế, một áp thấp nhiệt đới hiện đang hoạt động ngoài khơi phía Đông đảo Luzon (Philippines), với sức gió cấp 7, giật cấp 9. Hệ thống này đang di chuyển theo hướng Tây Tây Bắc với tốc độ 15–20 km/h và có khả năng mạnh lên thành Bão số 11 trong hôm nay hoặc ngày mai. * Vị trí và cường độ • Vị trí lúc 1h ngày 2/10: khoảng 14.5°N – 131.4°E, trên vùng biển phía Đông đảo Luzon (Philippines) với sức gió...

ÁP LỰC LOGISTICS TRƯỚC KỲ NGHỈ DÀI NGÀY TẠI TRUNG QUỐC VÀ HÀN QUỐC

Trong những ngày cuối tháng 9, hoạt động logistics quốc tế đang chịu áp lực lớn. Lượng hàng xuất nhập khẩu tăng mạnh để kịp giao trước kỳ nghỉ, trong khi một số khu vực vừa trải qua bão lớn khiến tình trạng quá tải tại cảng, tắc nghẽn đường bộ và chậm trễ lịch bay trở nên phổ biến. Nhiều quốc gia tại châu Á chuẩn bị bước vào kỳ nghỉ lễ kéo dài đầu tháng 10, dự kiến tác động mạnh đến chuỗi cung ứng khi các nhà máy, kho bãi và hải quan giảm công suất hoặc tạm...

CẬP NHẬT BÃO BUALOI (OPONG) – 26/09/2025

Theo Trung tâm Dự báo Khí tượng Thủy văn Quốc gia , bão Bualoi (tên quốc tế: Opong) hiện đang hoạt động ở phía Đông Philippines, gió mạnh nhất vùng gần tâm bão đạt khoảng 110 km/h, giật trên 150 km/h. Bão di chuyển theo hướng Tây – Tây Bắc với tốc độ 25–30 km/h và được dự báo sẽ vào Biển Đông tối 26/9, trở thành Bão số 10 trong năm 2025. Cơ quan khí tượng cảnh báo bão có thể mạnh thêm, đạt cấp 12–13 khi còn trên biển, trước khi ảnh hưởng trực tiếp khu vực Bắc...

CẬP NHẬT HOẠT ĐỘNG CẢNG BIỂN & HÀNG KHÔNG DO ẢNH HƯỞNG BÃO RAGASA

Hải Phòng, ngày 24/09/2025 – Trước diễn biến phức tạp của siêu bão số 9 (Ragasa), dự báo ảnh hưởng trực tiếp đến khu vực Đông Bắc Bộ, trong đó có thành phố Hải Phòng, các cơ quan chức năng, cảng biển, kho bãi và doanh nghiệp logistics đã triển khai các biện pháp ứng phó để đảm bảo an toàn cho người, phương tiện và hàng hóa. Hoạt động cảng biển và kho bãi trong nước • Cảng HTIT: Tạm dừng khai thác từ 24/9 • Kho CFS Hải An: Dừng khai thác và giao nhận từ 09:30 ngày 25/09/2025 đến khi...

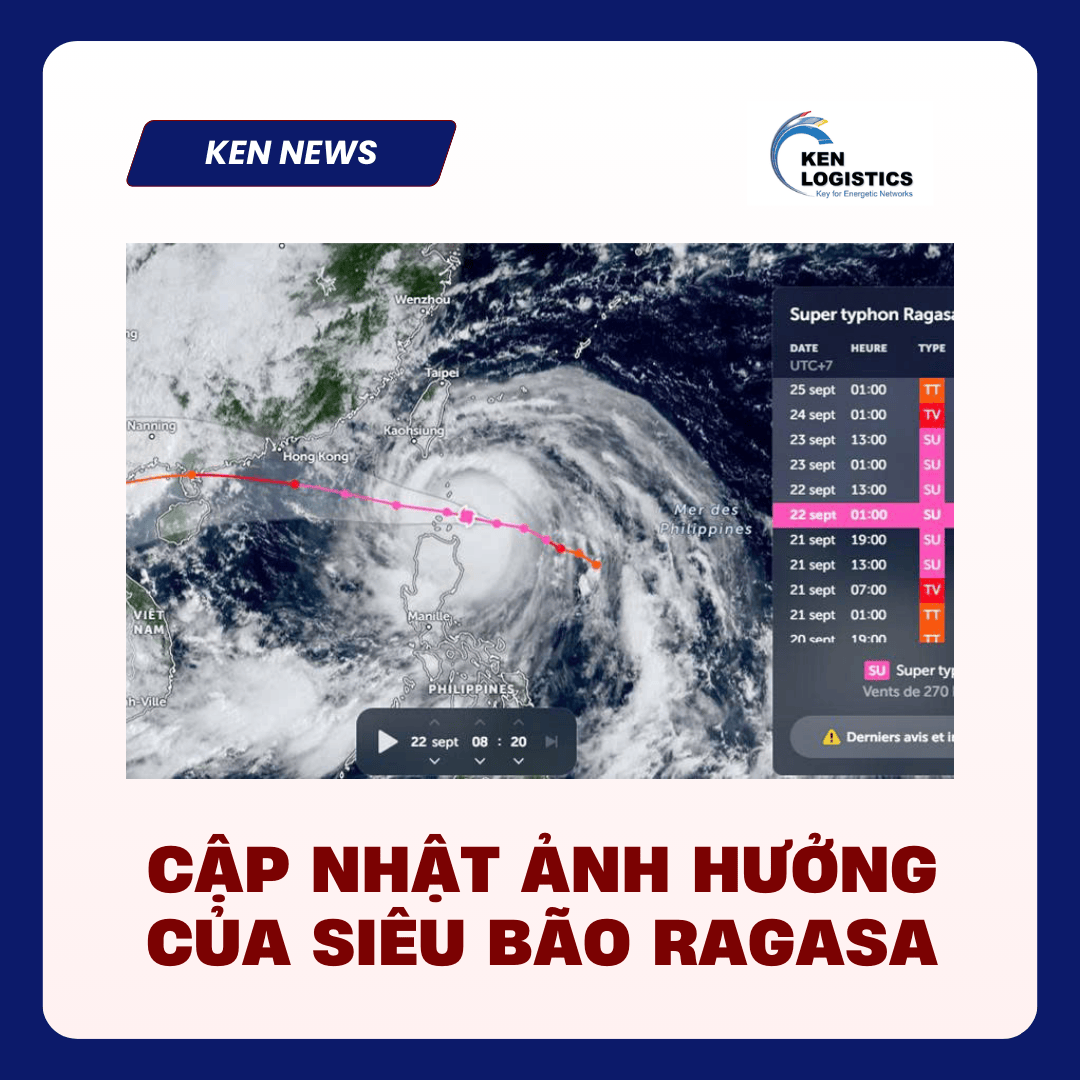

CẬP NHẬT – ẢNH HƯỞNG CỦA SIÊU BÃO RAGASA

Theo thông tin mới nhất từ Trung tâm Dự báo Khí tượng Thủy văn và các cơ quan quốc tế, siêu bão Ragasa hiện duy trì sức gió rất mạnh cấp 16-17, giật trên cấp 17, di chuyển theo hướng Tây Tây Bắc với tốc độ khoảng 20-25 km/h. Dự báo trong đêm 22/9, bão sẽ đi vào Biển Đông và trở thành cơn bão số 9 của năm nay. Đến ngày 24-25/9, bão có khả năng tiến gần và ảnh hưởng trực tiếp đến vùng Bắc Bộ và Bắc Trung Bộ Việt Nam, đặc biệt là khu vực từ...

CẬP NHẬT BÃO SỐ 7 – TAPAH.

Sáng ngày 08/09, Trung tâm Dự báo Khí tượng Thủy văn Quốc gia thông báo bão số 7 (tên quốc tế: Tapah) đang hoạt động trên khu vực Tây Bắc Biển Đông. Lúc 4h sáng, tâm bão ở khoảng 21,3 độ Vĩ Bắc – 112,9 độ Kinh Đông, sức gió mạnh cấp 10–11, giật cấp 13. Sóng biển cao từ 4 đến 6 mét, gây biển động dữ dội. Hiện nay, bão Tapah đã đi vào tỉnh Quảng Đông Trung Quốc và đang di chuyển theo hướng Bắc – Tây Bắc, cách Đông Nam Trạm Giang khoảng 300 km. Tình hình...