Hải Phòng, ngày 24/09/2025 – Trước diễn biến phức tạp của siêu bão số 9 (Ragasa), dự báo ảnh hưởng trực tiếp đến khu vực Đông Bắc Bộ, trong đó có thành phố Hải Phòng, các cơ quan chức năng, cảng biển, kho bãi và doanh nghiệp logistics đã triển khai các biện pháp ứng phó để đảm bảo an toàn cho người, phương tiện và hàng hóa. Hoạt động cảng biển và kho bãi trong nước • Cảng HTIT: Tạm dừng khai thác từ 24/9 • Kho CFS Hải An: Dừng khai thác và giao nhận từ 09:30 ngày 25/09/2025 đến khi...

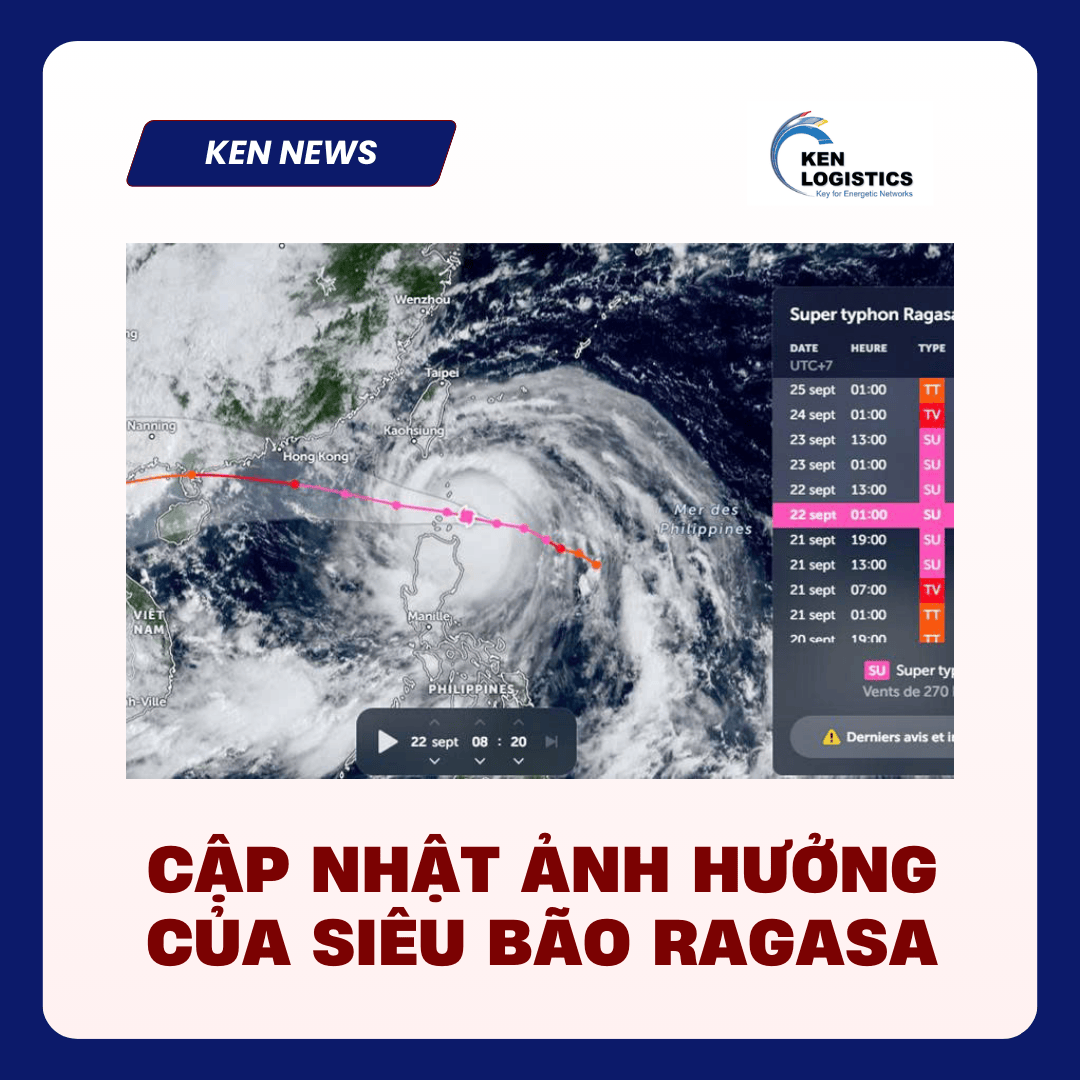

CẬP NHẬT – ẢNH HƯỞNG CỦA SIÊU BÃO RAGASA

Theo thông tin mới nhất từ Trung tâm Dự báo Khí tượng Thủy văn và các cơ quan quốc tế, siêu bão Ragasa hiện duy trì sức gió rất mạnh cấp 16-17, giật trên cấp 17, di chuyển theo hướng Tây Tây Bắc với tốc độ khoảng 20-25 km/h. Dự báo trong đêm 22/9, bão sẽ đi vào Biển Đông và trở thành cơn bão số 9 của năm nay. Đến ngày 24-25/9, bão có khả năng tiến gần và ảnh hưởng trực tiếp đến vùng Bắc Bộ và Bắc Trung Bộ Việt Nam, đặc biệt là khu vực từ...

THUẾ MỚI CỦA MỸ ĐÃ HIỆU LỰC NHƯNG BIỆN PHÁP PHẠT CHUYỂN TẢI CHƯA ÁP DỤNG NGAY

Các biện pháp xử phạt nghiêm khắc hơn đối với hành vi chuyển tải hàng hóa nhằm né thuế Mỹ sẽ chưa được triển khai ngay, dù chính quyền Trump đã ban hành mức thuế bổ sung lên đến 40% đối với các lô hàng bị xác định là “chuyển tải bất hợp pháp”. Hiện vẫn chưa có định nghĩa rõ ràng về “chuyển tải” cũng như quy tắc xuất xứ mới, nên các quốc gia Đông Nam Á như Việt Nam và Thái Lan tiếp tục áp dụng quy định hiện hành, chỉ xử lý...

The Ministry of Industry and Trade’s response on determining foreign trader without presence in Vietnam

According to Official Dispatch No. 2643/TCHQ-GSQL dated June 10, 2024 of the General Department of Customs(GDC) sent to the Ministry of Industry and Trade, in the process of carrying out customs procedures for on-spot import and export specified in Article 35 Decree No. 08/2015/NĐ-CP, customs authorities face challenges related to identifying foreign traders not present in Vietnam. To implement that regulation, it must be determined that foreign traders meet the condition of not having a presence in Vietnam, then are eligible for on-spot import and export cases. However, legal documents on commerce and foreign trade only stipulate the definition of foreign...

SOME AMENDMENTS REGARDING ORIGIN OF GOODS IN THE AKFTA AGREEMENT

The Ministry of Industry and Trade has just issued Circular No. 04/2024/TT-BCT, amending and supplementing a number of articles of Circular No. 20/2014/TT-BCT. Circular No. 04/2024/TT-BCT takes effect from May 11, 2024. Circular No. 04/2024/TT-BCT amends Article 4, ANNEX I (Rules of Origin) issued together with Circular No. 20/2014/TT-BCT to granting exporters/manufacturers the right to choose the formula for calculating Regional Value Content (RVC) in terms of direct or indirect calculation method for fixed use throughout a financial year and for post-audit verification. Moreover, the Circular amends Clause 1, Article 5, APPENDIX V (Procedures for issuance and inspection of C/O) to legalizing...