On 8th August 2023, The General Department of Customs has issued Official Letter 4146/TCHQ-GSQL 2023 to answer questions of Associations and Enterprises related to on-the-spot export and import after issuing Official Letter 2588/TCHQ-GSQL 2023. Based on the provisions of the Commercial Law, the Law on Foreign Trade Management, and the transactional nature of the goods, the exported or imported goods must be brought out/into the Vietnamese territory or brought out/into the customs area. But to on-the-spot export and import activities, goods are bought and sold within the domestic market and there is no movement of goods out of the border of...

OPENING OF VIETNAM - CHINA RAILWAY TRANSPORT ROUTE

Vietnam - China railway transport route from Shijiazhuang City in China to Yen Vien Station in Hanoi, Vietnam is opened on 2rd August 2023. This train departs from Shijiazhuang City, Hebei Province, China to Yen Vien Station with a journey of 2,700 km, taking over 4 days. The train has 23 carriages. This is the first train of the freight route between the two countries, organized jointly by the railway department of Vietnam and China. This train runs straight, helping businesses shorten the transportation time compared to the time of transporting goods at the border as before and more convenient in carrying...

RESTORE OPERATIONS AT MUONG KHUONG BORDER GATE, LAO CAI

Lao Cai Provincial People's Committee has just decided to restore operations at Muong Khuong border gate in Muong Khuong district. It is expected that from 27th July, 2023, activities will be restored at the Muong Khuong border gate (Lao Cai, Vietnam) - Kieu Dau (China) to restore import-export activities through this border gate. In the coming time, Lao Cai Provincial People's Committee will assume the prime responsibility and coordinate with the forces involved in the management of Muong Khuong border gate to organize the restoration of import and export activities through this border gate. At the same time, the Management Board...

NEW EXPORT AND IMPORT TARIFF SCHEDULE UNDER DECREE NO.26/2023/ND - CP AND DECISION NO.15/2023/QD-TTg EFFECTIVE FROM 15TH JULY 2023

On 31st May, 2023: 1. The Government issued Decree No. 26/2023/ND-CP (Decree 26) promulgated the export tariff schedule, Most Favoured Nation (“MFN”) import tariff schedule, list of goods and absolute tariff, mixed tariff, out-of-quota tariff. 2. The Prime Minister signed off Decision No. 15/2023/QD-TTg (Decision 15) promulgating the normal import tariff applied to imported goods. The new export and import tariff schedule will be effective from 15th July 2023. In Decree No. 26, three main groups of contents have been amended and supplemented, such as: Converting the export tariff schedule, Most Favoured Nation import tariff schedule, list of goods and absolute tariff, mixed...

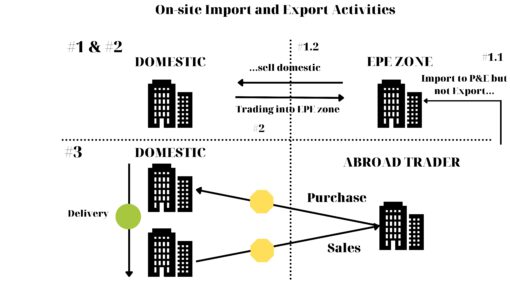

PLAN FOR CHANGING REGULATION OF ON – THE – SPOT EXPORT AND IMPORT

On 29th May, 2023 the General Department of Customs has just issued Official Letter 2588/TCHQ-GSQL 2023 on commenting on the draft amendment and supplement to Article 35 of Decree 08/2015/NĐ-CP for on-the-spot export and import. 1. Currently, Customs procedures of on-the-spot exported and imported goods is regulated as Article 35 Circular 08/2015/NĐ-CP dated 21st January, 2015: Article 35. Customs procedures that must be followed by on-the-spot exports and imports 1. On-the-spot exports and imports shall include: a) Those produced in Vietnam under contract manufacturing arrangements and sold to Vietnamese organizations or individuals by overseas ones; b) Those traded under the sale and purchase contract between...

SOME NEW POINTS IN NEW CIRCULAR 33/2023/TT-BTC ABOUT ORIGIN CARGO (REPLACE: 38/2018/TT-BTC)

On 31st May, 2023, the Ministry of Finance issued Circular 33/2023/TT-BTC about the regulations the origin of exported and imported cargos. Circular 33/2023/TT-BTC officially takes effect from 15th July, 2023 and will replace the following Circulars: 38/2018/TT-BTC about checking origin cargo 62/2019/TT-BTC update circular 38/2018/TT-BTC 47/2020/TT-BTC about time to submit CO in Covid time 07/2021/TT-BTC about time to submit CO from EU The regulation of origin of exported cargos: Article 5. Declare Origin of export cargo on the CD 1. Declare Origin of cargo with Description of Goods Origin Vietnam: Description of Goods#&VN Other country Origin: Description of Goods#&(country) ...