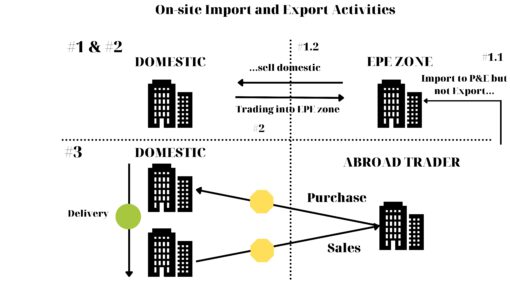

On 29th May, 2023 the General Department of Customs has just issued Official Letter 2588/TCHQ-GSQL 2023 on commenting on the draft amendment and supplement to Article 35 of Decree 08/2015/NĐ-CP for on-the-spot export and import. 1. Currently, Customs procedures of on-the-spot exported and imported goods is regulated as Article 35 Circular 08/2015/NĐ-CP dated 21st January, 2015: Article 35. Customs procedures that must be followed by on-the-spot exports and imports 1. On-the-spot exports and imports shall include: a) Those produced in Vietnam under contract manufacturing arrangements and sold to Vietnamese organizations or individuals by overseas ones; b) Those traded under the sale and purchase contract between...

VIETNAM - KOREA OFFICIALLY CONNECT THE EXCHANGING ELECTRONIC CERTIFICATE OF ORIGIN (EODES) FROM 1ST JULY 2023

Vietnam - Korea have just signed a Joint Statement on technical connection of EODES Electronic Origin Data Exchange System, supporting the transmission and reception of Certificate of Origin (C/O) data through the EODES system between the two countries effective from 1st July 2023. The transmission and reception of Certificate of Origin (C/O) data through the EODES system between Vietnam and Korea speeding up the process and procedures for issuing C/O in the exporting country as well as customs clearance of goods based on electronic C/O data to get the VKFTA and AKFTA tariff preferences in the importing country, reducing the pressure...

IMPORTED PROCESSED PRODUCTS FOR EXPORT PROCESSING NOT SUBJECT TO IMPORT TAX REFUND

According to regulations, the processed products that are imported and then processed in Vietnam for export are not subject to an import tax refund. The country’s top customs regulator cites Article 19 of the Law on Import and Export Duty as saying that cases of tax refund are below: Any taxpayer who has paid export duty or import duty but has no exports or imports, or the number of exports or imports is smaller than the quantity on which duty is paid; Any taxpayer who has paid export duty but the exports have to be re-imported will receive a refund of export duty...

SITUATION OF IMPORT AND EXPORT OF VIETNAM'S GOODS IN THE SECOND HALF OF APRIL 2023 (FROM 16 TO 30 APRIL, 2023)

The latest preliminary statistics of the General Department of Customs show that the total import and export value of Vietnam's goods in the period of second half of April 2023 (from 16th to 30th April, 2023) reached 26, $78 billion, an increase of 2.7% (equivalent to an increase of $702 million) compared to the results in the first half of April 2023. The results achieved in the second half of April 2023 brought the total import-export value of the whole country in the four months of 2023 to reach US$ 206.76 billion, down 15.3% (equivalent to US$ 37.47...

250 PROCEDURES CONNECTED WITH NATIONAL SINGLE WINDOW

In addition to connecting the National Single Window, the General Department of Customs is coordinating with relevant ministries and agencies in connecting the Single Window with partners inside and outside the ASEAN region. As the Standing Agency of the National Steering Committee on ASEAN Single Window, National Single Window and Trade Facilitation (Steering Committee 1899), the General Department of Customs has been urging and closely working with ministries and agencies to implement the National Single Window, the ASEAN Single Window, and ASEAN Trade Facilitation. Accordingly, the General Department of Customs has mobilized resources to build a master plan for developing an information...

LARGE-SCALE NON-TARIFF ZONE TO BE BUILT IN HAI PHONG

Xuan Cau Industrial Park and Non-Tariff Zone is being built at Lach Huyen international port area, Cat Hai district, Hai Phong. Tan Cang - Hai Phong International Container Terminal (TC- HICT) is the first terminal built and put into operation at Lach Huyen international port. The project has a total investment of 11,100 billion VND, located on an area of 752 hectares, located in the area of Lach Huyen international gateway port, Dinh Vu - Cat Hai economic zone. attracting about 40,000 - 50,000 workers. Non-tariff zone - Logistics and Lach Huyen Industry located in...